This month’s guest blog is written by Lisa Grove of Above & Beyond Admin Services. Lisa has over 20 years’ experience in business. She is trained in Business Administration, Bookkeeping, Customer service, International Trade and Service and Project management.

As a global account manager, she co-ordinated end to end logistics solutions for many blue-chip companies, including those in the Military, Aerospace and Retail sectors. Her hard work was recognised as she was awarded Runner Up BIFA Young Freight Forwarder of the Year, UKACC Customer Service Agent of the Year and the YRC President’s Award Winner.

The majority of us can’t wait to see the back of 2020, it’s certainly brought it’s challenges.

However, as many plan ahead focusing on a more positive 2021, the new year ahead brings new challenges for many in the retail world.

I can’t tell you how many times I’ve been asked, but what do I need to do? Unfortunately, there isn’t a one size fits all answer to this. Obviously, what commodity you import or export, along with the volume of product will be major factors. If you haven’t already, the first place to start is with the government’s Check, Change, Go.

EORI Numbers

You will however, need EORI in place regardless of if you are VAT registered or not. It is very simple to apply for, takes less than 72 hours to come through and is free to get, so don’t let anyone charge you!

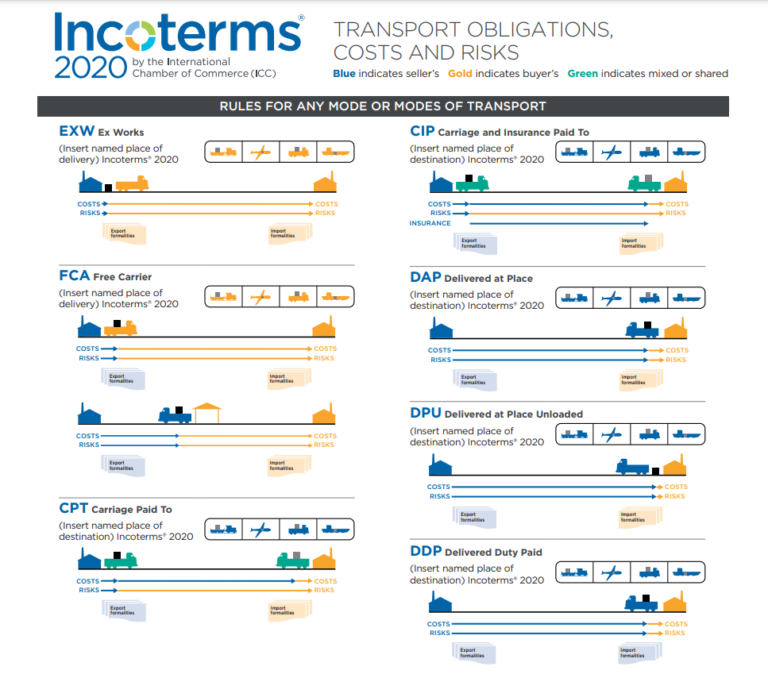

INCOTERMS

You also need to review your INCOTERMS and re-confirm them with your suppliers. The guidance is currently that DDP is switched to DAP and EXW is switched to FCA. If you’re not sure about the responsibilities of each, then hopefully the diagram below will help.

What's and HTS?

You also need to know what 10-digit commodity code (HTS) apply to your products, and ideally, that they are included on your invoices. Remember that only the first six digits of the HTS code are internationally recognised. So, if you import the same product from China for example, then please don’t rely on the code issued by your Chinese supplier.

Other than that, the documentation requirements haven’t changed a great deal. HMRC are suggesting that you should have both the importer and exporters EORI number on your commercial invoice as well as the HTS code. If anyone is struggling with classification, I’d be happy to help. I worked in customs compliance for years, and still offer classification and entry preparation services for some of my long-term clients.

What about Duty and VAT?

From a retail and business point of view, you need to factor in the potential duty and VAT. VAT may be able to put through intrastat’s and there is already an option in place to process this over a six-month period in some cases, however, I would (despite generally being an optimist!) prepare for the worse case, of having to pay an additional 30%+ in some cases, of the value of goods being imported. Don’t forget that any applicable duty will also need to be factored into the cost of the product – there has been an update on the HMRC tariff from January 2021, but this detail still isn’t 100% clear – however, there has been an update within the last week, so it’s worth frequently re-checking.

You can of course ask your courier/haulier/forwarder for advice and further info, but please remember that it’s your responsibility as an importer/exporter to be compliant. Their advice is just that, and unfortunately in this country there is no such thing as a licensed broker, so that guidance can vary greatly at times.

Making a declaration to HMRC

Customs declarations will need to be made on all import and export movements. You can complete

the declaration yourself or use a forwarder or broker. You are responsible for the declarations, even if you have a forwarder or agent doing this for you. It is best to provide them with instructions rather than leave them to their own devices. If they make a mistake, and you have not issued any instruction, you are fully liable for those errors.

How can I prepare my business?

There are some actions that you can take now

- Apply for a GB EORI number (If you’ve already got one, then you’re ahead of the game here!)

- Source a Customs Intermediary – either a customs agent, Freight Forwarder or broker. Start by asking your current transport provider if they’re able to help, and most importantly what they’ll charge.

- Prepare resources for entry instructions – Origin of goods will need to be determined, customs classification and customs value.

- Assess your transport movements and port locations. What back-up locations could you use should certain ports or hubs become congested?

- Monitor changes and updates to trade agreements related to your business or products.

- Find out if anyone in your supply chain will be putting their prices up to cover additional Brexit costs.

- Contact UK suppliers and establish if they are stockpiling to cover any potential delays at the boarders.

- Review your current contracts – do you have any that include penalties for late delivery? If you do, then see if they can be renegotiated or at least clause with a reference to port congestion as a result of Brexit.

What if I have a higher volume of shipments?

- Consider applying for a Duty Deferment Account: When you’re importing goods regularly it can be beneficial to have a duty deferment account (DDA). This enables customs charges, including customs duty, excise duty, and import VAT to be paid once a month through Direct Debit instead of being paid on individual consignments.

- You can also investigate if a SIVA Deferment account might be beneficial (Simplified Import VAT Accounting). This works on a similar basis to a Duty Deferment Account, but only enables payment of VAT on account. You will need to have your customs and VAT records in order, for the last 3 years. It is still possible to apply if you’ve been VAT registered for less than three years, but you will be subject to more stringent credit reference checks.

Please don’t panic or be overwhelmed by the terminology here. These are both just options, and realistically, they will only be beneficial if you are shipping large volumes of stock, frequently.

Retailer Resources Round Up

I wish I could give you a magic wand or at the very least a failsafe list of actions to ensure you are 100% ready. Sadly, a great deal of the conditions are still being finalised. Some tariff rates for 2021 have been announced, many have not. Which doesn’t help anyone right now.

On a more positive note, the logistics industry has been preparing for these changes for a long time. Behind all the speculation and uncertainty, preparations have carried on regardless.

Forwarders have been taking on extra staff and HMRC have committed to building new border facilities in the UK for carrying out the required checks. Both are in continual consultation with ports across the UK to agree what infrastructure is required.

The best advice I can give you right now as business owners, is to work through the action points above and ensure that you are as prepared as you can be. If you’re VAT registered, then HMRC would have written to you by now with a list of steps to take. If you haven’t already gone through that, then dig that brown envelope out and check what’s required specifically to your business.

Try not to feel overwhelmed. Work out a list that is applicable to your supply chain. Then break it down into manageable chunks. Start with Check, Change, Go, then apply for your EORI, if you haven’t already. Prioritise the rest by urgency and time to implement.

If you struggle with organisation or time management generally, then you might like to download Lisa’s Essential Digital Toolkit to help you manage your Brexit task list.

As a business owner herself, Lisa has been fortunate to work with a variety of different business across many sectors, including carrying out compliance projects, such as researching and collating worldwide import procedures, documentation, duty and VAT rates on requested commodities. This has given her an insight into many different systems and structures, what works and what doesn’t.

Lisa believes that these systems should be made available to all business owners so has developed the Business Support Hub to assist with getting the business basics right, building on those foundations and increasing the chances of success. Lisa has recently featured in the Telegraph’s Business Owners Checklist, where the Business Support Hub Start-up resources were spotlighted.

When she’s not working, she is kept busy by her two boys (aged 13 and 5 – going on 25!), and their scatty springer spaniel. Her proudest business achievement to date (other than running her own business) is being one of the few civilians to have flown in the cockpit of a Boeing C-17.